Budget 2025: Govt revenue in FY2024 lifted by various taxes, clocks $6.4b surplus

Sign up now: Get ST's newsletters delivered to your inbox

The Ministry of Finance said firms paid more in corporate income tax, which was up 6.5 per cent year on year to $30.9 billion in FY2024.

ST PHOTO: CHONG JUN LIANG

Follow topic:

SINGAPORE - Singapore’s national coffers have been boosted by better-than-expected revenue in fiscal year (FY) 2024, led by the jump in corporate income tax, Prime Minister and Finance Minister Lawrence Wong said in his Budget speech on Feb 18.

The Ministry of Finance (MOF) said firms paid more in corporate income tax, which was up 6.5 per cent year-on-year to $30.9 billion in FY2024. This is up from the estimated $28 billion.

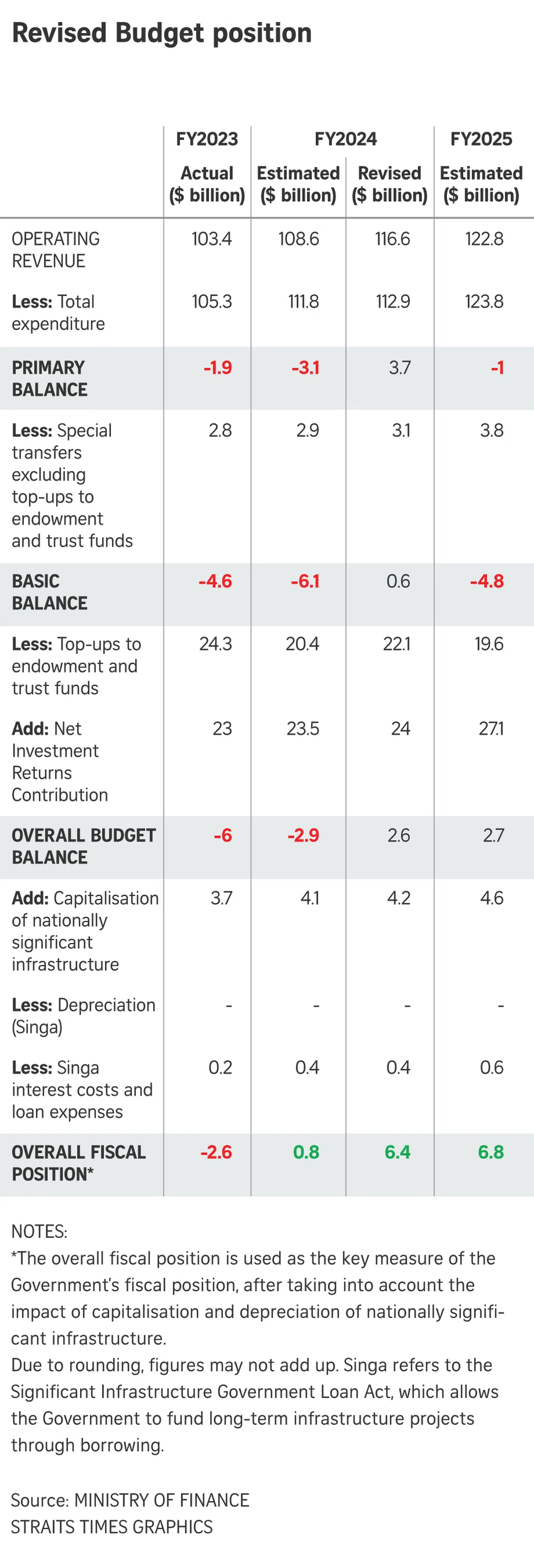

The higher collection helped improve Singapore’s fiscal position, from an overall Budget deficit of $2.6 billion in FY2023 to a surplus of $6.4 billion in FY2024, which is about 0.9 per cent of gross domestic product (GDP).

Corporate income tax collection is estimated to hit 4.1 per cent of GDP in FY2024, higher than the usual 3.2 per cent in past years.

PM Wong said the larger amount of corporate income tax collected is due to several reasons, including industry-specific cyclical factors in finance and wholesale trade, as well as possible changes in investment decisions of multinational enterprises as they seek stable centres like Singapore for their high-end activities.

Calling it an unexpected change, he said corporate income tax is now the single largest contributor to total revenue, even higher than the Net Investment Returns Contribution (NIRC), which came in at $24 billion in FY2024. In FY2023, it was $23 billion.

Another key contributor to revenue was the amount collected in goods and services tax (GST) that rose 23.8 per cent year-on-year to $20.6 billion in FY2024. MOF said this was due to stronger-than-expected growth in private consumption.

PM Wong said that in this term of government, several changes were made to Singapore’s tax system, including the GST rate increase.

He said the increase in GST rate, which went up to 9 per cent in 2024 from 8 per cent in 2023 and 7 per cent in 2022, ensures the Government has the revenues to look after the growing number of seniors, even as healthcare costs go up.

The impact of the GST increase has been cushioned and delayed via the Assurance Package for the majority of Singaporean households, PM Wong said, adding that the GST system is designed with permanent GST vouchers.

This ensures that lower-income households pay a far lower effective GST rate than higher-income ones, he said.

Personal income tax collected came up to $19 billion in the same period, up 8.3 per cent, due to better nominal wage growth.

“While our revenues have increased, we have also spent more on Singaporeans. For example, we provided $3 billion in MediSave top-ups in December last year, which will help to cushion the increases in MediShield Life premiums to fund better coverage and higher payouts,” PM Wong said.

He added that resources have been earmarked for projects to boost economic competitiveness, such as developing critical infrastructure like Changi Terminal 5 and for energy transition.

For FY2025, the Prime Minister expects a similar fiscal position, with a surplus of $6.8 billion. This is 0.9 per cent of GDP.

“There could be some additional corporate income tax revenue from FY2027 onwards, with the implementation of the domestic top-up tax, which will raise the large multinational enterprises’ (MNE) effective tax rate to 15 per cent.

“But how much revenue we will get from this change depends on whether these MNEs continue to find it attractive to remain in Singapore,” PM Wong said.

In his speech, PM Wong also said that Singapore’s tax system will continue to ensure fairness and improve progressivity, with those who are better off paying more in taxes to help those who are not.

It is why Singapore’s property tax rates were raised for all non-owner-occupied residential properties. These are properties that are mainly for investment, and higher-value residential properties occupied by owners.

These changes coincided with a sharp increase in annual values of properties, which went up because of supply constraints led by the pandemic.

So, the Government has revised and updated the annual value bands of property tax rates for residential properties that are owner-occupied. The move allows more homes to fall within bands of lower tax rates.

In addition, the Government has also provided property tax rebates. For instance, in November 2024, it announced another rebate of up to 20 per cent for owner-occupied residential properties in 2025, capped at $1,000.

In all, PM Wong said all HDB owner-occupiers and more than 90 per cent of private residential properties that are owner-occupied will see lower property taxes in 2025.

PM Wong also warned that there is considerable uncertainty about how government revenues will be in the coming years, especially given the current great uncertainty about the global tax environment after the US went back on earlier consensus achieved by the Organisation for Economic Cooperation and Development (OECD) and other countries.

American President Donald Trump in late January declared that the global corporate minimum tax deal “has no force or effect” in the US, effectively pulling out of the agreement.

In its outlook for FY2025, MOF projected corporate income tax collections to grow by 5.8 per cent to $32.7 billion, due to strong economic growth in 2024.

Collections from personal income tax and GST are also expected to grow.

Along with this trend, expenditure in FY2025 is also expected to go up, in areas like healthcare and for the Defence Ministry to ramp up critical projects.

The estimated FY2025 NIRC is $27.1 billion, about 12.9 per cent higher than FY2024.

PM Wong noted that MOF’s projection for government spending to increase to around 20 per cent of GDP by 2030 still stands.

Government expenditure has risen from $75.3 billion in FY2019 to $112.9 billion in FY2024. It is estimated to go up to $123.8 billion in FY2025.

PM Wong said the Government will continue to monitor fiscal trends closely, spend responsibly and ensure all Singaporeans benefit from the nation’s progress.

Read next - Part-time training allowance, corporate income tax rebate: Budget 2025 help for workers and firms