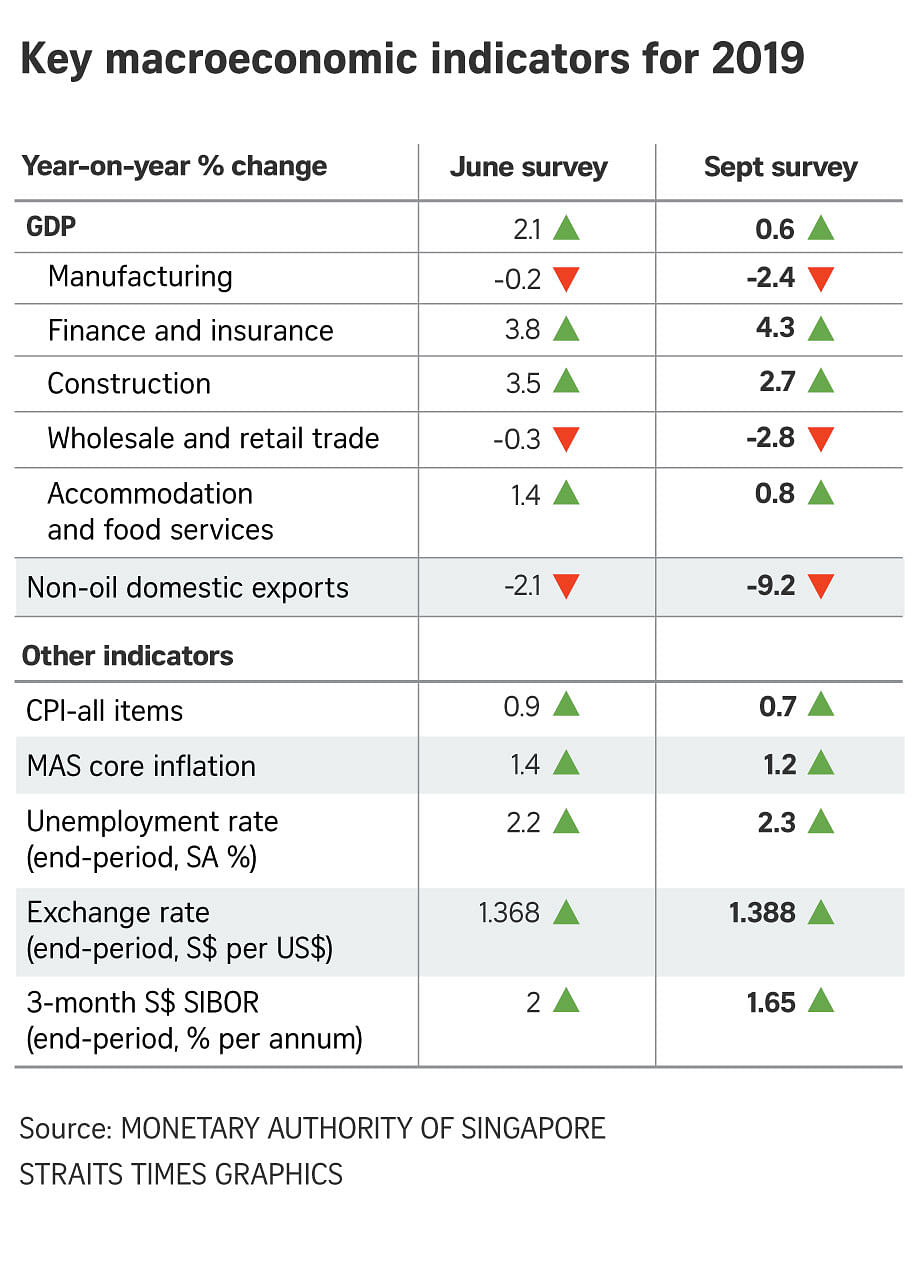

SINGAPORE - Private sector economists have sharply lowered their forecast for growth in the Singapore economy this year to 0.6 per cent, from the 2.1 per cent expansion they saw in June, according to the latest quarterly survey of professional forecasters by the Monetary Authority of Singapore released on Wednesday (Sept 4).

Their lower forecast is in line with official estimates. Last month, Singapore slashed its 2019 forecast to between 0 and 1 per cent from 1.5 to 2.5 per cent previously, tipping growth to come in "around the mid-point" of the forecast range. This came as growth in the second quarter slowed to 0.1 per cent from 1.1 per cent in the first three months of the year.

For the third quarter, the economists polled by MAS expect year-on-year growth of 0.3 per cent.

Compared to their June predictions, their forecasts fell for most sectors, including manufacturing, construction, wholesale and retail trade, accommodation and food services and non-oil domestic exports.

They are most pessimistic about non-oil domestic exports, expecting shipments to contract by 9.2 per cent, much worse than their June prediction of a 2.1 per cent decline.

They also expect manufacturing to shrink by 2.4 per cent, down from the estimated 0.2 per cent dip in June.

The economists also maintained a gloomier outlook for retail and wholesale trade, downgrading their growth figures to 2.8 per cent decline, down from the predicted 0.3 per cent drop in June.

However, they expect the finance and insurance sector, and private consumption to grow.

The economists cited their top concern as the further escalation of trade tensions, in particular between the US and China.

A further economic slowdown in China, brought about by external uncertainty and domestic financial market instability, also continued to be a concern for half of the survey respondents.

Geopolitical risks in places such as Hong Kong and the Persian Gulf were also widely cited as a downside risk.

On the upside, economists said the easing of trade tensions could contribute to a stronger-than-expected growth in Singapore. However, they also believe that such easing is becoming less likely.

Other potential areas of hope are fiscal stimulus, both in Singapore and elsewhere, and easing global financial conditions led by more accommodative monetary policy in developed markets.

Besides GDP growth, economists also downgraded their expectations for overall inflation and core inflation. Respondents expect overall inflation to come in at 0.7 per cent, down from an earlier prediction of 0.9 per cent in June.

They expect core inflation to come in at 1.2 per cent, down from 1.4 per cent in June.

They also foresee the Singapore currency weakening against the US currency, from $1.368 per dollar to $1.388.

The three-month Singapore Interbank Offer Rate (Sibor) - the benchmark for the pricing of most home loans - is expected to drop to 1.65 per cent from 2 per cent in the June survey.

A total of 23 private sector economists and analysts responded to the survey conducted last month.

It showed that the most likely outcome is for the Singapore economy to grow by between 0.5 and 0.9 per cent this year, with a 37.3 per cent average probability assigned to this range. This is lower than the previous survey, in which the most likely outcome for growth this year was expected to be between 2 and 2.4 per cent.